In crypto news today, a few familiar names are back in the limelight. Fidelity CEO Abigail Johnson said she personally owns BTC and openly called Bitcoin the gold standard. At the same time, as Hal Finney, the creator of Bitcoin, and Satoshi Nakamoto discussions are circulating once again, the current price is still leaving us unsure about what kind of market we are really in.

Fidelity has been buying quietly. Over recent months, the firm picked up millions of dollars’ worth of Bitcoin during market weakness. But the Bitcoin price has yet to act like we are in a classic bull cycle, although institutional buyers keep showing up anyway. In crypto news today, this contrast is worth watching.

BREAKING:

Fidelity has bought $26.7 million worth of Bitcoin. pic.twitter.com/pbeax2Ybx5

— Ash Crypto (@AshCrypto) December 17, 2025

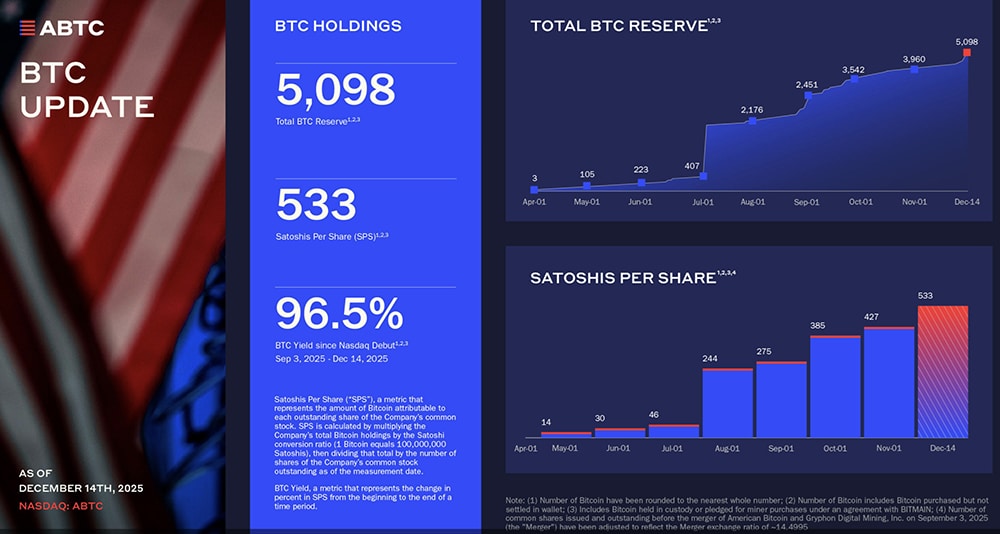

Another example came from American Bitcoin Corp. The Trump family-backed mining company added 54 BTC to its holdings, bringing the total to 5,098 BTC. That now places the company at number 20 among the largest known Bitcoin treasury firms. This reinforces the same theme of long-term accumulation despite short-term uncertainty.

(source – PRN)

Abigail “Fidelity” Johnson’s comments stood out as she confirmed she owns Bitcoin herself and framed BTC as the benchmark for the entire digital asset, despite the current price point.

Even with the Bitcoin price stalling, big boys are not stopping and adding exposure; they are steadily positioning.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Major News from Crypto Today: Hal Finney Satoshi Links, Fidelity Bitcoin Stance, and a Look Toward 2026

The Hal Finney Satoshi mystery has resurfaced yet again. Early forum posts, emails, and long-circulated photos are being reexamined. Finney was the recipient of the first Bitcoin transaction, which naturally keeps the question alive:

Was he Satoshi, or did he simply know who Satoshi really was?

No new proof has emerged, but the discussion continues.

If you look at the macro picture the evidence points towards Satoshi Nakamoto being a pseudonym for a group of cypherpunks; not an individual. I believe Hal was one of the largest contributors.

Bitcoin genesis key contributors likely one or more of:

– Hal Finney

– Len Sassaman… https://t.co/WLWaEmgxHP— BlockchainDan

(@BlockchainDan) December 17, 2025

On the market side, 2025 has been confusing, and it still is. Bitcoin stalled, Ethereum failed to break out, and Solana dropped hard. Some analysts now argue that institutions were deliberately trapping bear traders. When the data is reviewed, the macro picture explains a lot.

Global net liquidity fell through 2025. PMI stayed in contraction. Quantitative tightening continued. That combination doesn’t support a bull market. Looking ahead, 2026 looks different. QT has ended, rates are moving lower, liquidity is stabilizing, and institutions appear ready for a second wave.

In crypto news today, it’s starting to look less like 2025 failed and more like it was simply early. With Fidelity Bitcoin accumulation ongoing, Hal Finney Satoshi debates back in circulation, and macro conditions shifting, the Bitcoin price may finally find real momentum next year. We just need to be ready and position ourselves early.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Ethereum Crashes Below $3K as Liquidations Spike and Volatility Looms

Ethereum price (ETH USD) has broken below the psychologically key $3,000 level, with Ethereum price action now hovering in a fragile consolidation zone after a sharp sell-off. At the time of writing, ETH is trading around $2,900–$2,950, down roughly 5–7% over 24 hours, while its market cap has slipped toward the mid-$340 billion range.

The move comes as nearly $600 million in leveraged crypto positions were flushed out in a single day, and traders brace for a potential volatility spike driven by weak technicals and mixed institutional flows.

GM FAM

Yesterday we saw $BTC drop below 86K, triggering $600M+ in liquidations. The key driver was derisking ahead of the Bank of Japan interest rate decision.

We’re now in extreme fear, this is where we slow down and analyze.

A few reminders:

– Avoid multiple open positions… https://t.co/dNK0Cw3ULO pic.twitter.com/Ac3ysOjsLe— Kapoor Kshitiz (@kshitizkapoor_) December 16, 2025

Read the full story here.

The post Crypto Market News Today, December 17: Fidelity Says Bitcoin Is the Gold Standard as They Scoop The Bottom Price and Hal Finney–Satoshi Talk Returns appeared first on 99Bitcoins.